Last updated: February 27, 2017

The United States generates about one fifth of its electricity from nuclear power, making it the country’s largest zero-emissions energy source. The national rate of nuclear power consumption has remained relatively constant since around 1990. Since 2013, five nuclear plants have closed in the U.S. and have been replaced mainly by natural gas and some wind, solar and energy efficiency measures. Four more nuclear plants are scheduled to close by 2025, and another four plants are at risk of closing after May 2017 if they fail to win contract bids at an upcoming grid operator auction. While some government-sponsored research claims that nuclear energy is necessary to cut carbon dioxide emissions, other research shows that the world can achieve its climate goals by completely transitioning from fossil fuels and nuclear to wind, solar and other renewable energy sources. Some states are deciding whether to subsidize aging nuclear plants to save jobs and protect local sources of tax revenue. There is a policy disconnect between the short-term horizon of state and federal energy planning, which often encompasses jobs and economic considerations, and long-term goals to reduce greenhouse gas emissions. As the nuclear fleet ages, policymakers will have to decide whether to subsidize these plants or replace them, likely with natural gas or renewables.

Table of Contents

Energy Pathways to Achieve Emissions Reductions Goals

Pros and Cons of Nuclear Energy

Reasons Behind Recent Plant Closures

Introduction

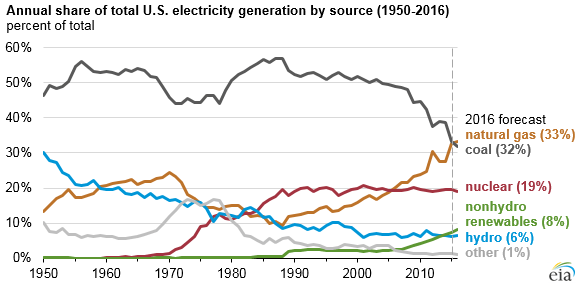

Nuclear energy has consistently supplied about one fifth of the U.S. electricity demand since 1990, but its future trajectory is uncertain. The graph below shows energy trends over the last six decades:

(Energy Information Administration)

Amid this shifting energy landscape, states are grappling with what to do with their aging fleet of nuclear power plants, most of which were built in the 1960s and 1970s and are nearing retirement age. Nuclear energy faces high operating costs and competition from cheaper gas and renewable energy sources, making the business of running the nation’s nearly 100 nuclear plants unprofitable.

The conventional model for operating the electric grid requires “baseload” power, mostly from coal, nuclear and increasingly natural gas plants. But that model could become obsolete as renewable energy and distributed generation sources supply more and more power to the grid. Innovations like active grid management, regional transmission lines and energy storage provide the coverage and security that local baseload power previously generated. Therefore, as renewables ramp up, grid efficiency increases and energy consumption becomes more efficient, the need for large baseload generators to balance the intermittency of renewables drops substantially.

Some states are exploring the possibility of subsidizing existing nuclear plants to preserve jobs and to achieve emissions reduction targets in the short term as the country transitions from fossil fuels to renewables. Other states are letting their nuclear plants shut down and replacing them mostly with natural gas generators, along with some wind and solar power plants and energy efficiency measures.

Energy Pathways to Achieve Emissions Reductions Goals

By signing the 2015 Paris Agreement, the U.S. committed to reduce its greenhouse gas emissions by 26-28 percent below the 2005 level by 2025.

Government agencies, international organizations and academics differ on whether nuclear energy is needed to achieve national and international emissions reduction targets. Some consider nuclear as an indispensable low-carbon energy source that must maintain, or even increase, its proportion of the global energy mix while renewables scale up and replace fossil fuels. Others view nuclear as an antiquated, expensive option that survives only through subsidies and cannot ultimately compete with low-cost wind and solar power. Providing subsidies to nuclear power, they say, is simply wasting money that could be spent building out renewable energy.

Energy Transition without nuclear:

- Stanford University atmospheric scientist and civil engineer Mark Jacobson argues that wind, solar and hydropower are the cheapest sources for the U.S. to transition to 80 percent renewable energy by 2030 and 100 percent by 2050, all without nuclear or fossil fuels: “the United States can convert its all-purpose energy systems (for electricity, transportation, heating/cooling, and industry) to systems powered entirely by wind, water, and sunlight while using no nuclear power, coal with carbon capture, liquid or solid biofuels, or natural gas.”

- A study by a team of researchers in Japan assesses the technological feasibility and economic viability of cutting greenhouse gas emissions in half by 2050 without nuclear energy or carbon capture and sequestration (CCS). It finds that achieving that goal is technically feasible but would be costly, given the additional investment needed for new technologies that could “compensate for emission increases in the steel, cement and power generation sectors in the absence of CCS.” But improvements in the materials used for constructing equipment, material substitution and efficient use of those materials could significantly reduce this added cost.

- The 2015 U.S. Deep Decarbonization Pathways, a project by the Sustainable Development Solutions Network, outlines four decarbonization scenarios — high renewable, high nuclear, high carbon capture and sequestration, and mixed cases — to meet the target of cutting emissions 80 percent below 1990 levels by 2050. It is possible to achieve that goal using no nuclear energy in a pathway that “would require the deployment of roughly 2,500 GW of wind and solar generation (30 times present capacity) in a high renewables scenario.”

Energy Transition with nuclear:

- The International Energy Agency (IEA) includes nuclear with other sources of low-emissions energy in its technology roadmap. The IEA says that “to achieve the goal of limiting global temperature increases to just 2 degrees Celsius (°C) by the end of the century, a halving of global energy-related emissions by 2050 will be needed. A wide range of low-carbon energy technologies will be needed to support this transition, including nuclear energy.”

- Under President Obama, the U.S. Environmental Protection Agency considered nuclear an integral part of the Clean Power Plan (CPP), a national policy to reduce carbon emissions from the electric power sector 32 percent below 2005 levels by 2030. (President Trump has signalled he will dismantle CPP.) The EPA states that “nuclear power is part of an ‘all the above’ energy strategy that supports economic growth and job creation, enhances our nation’s energy security, and protects the planet for future generations. The Clean Power Plan (CPP) ensures that zero carbon nuclear power will continue to play a prominent and meaningful role in America’s energy mix.”

- The U.S. Energy Information Administration (EIA) envisions a steady supply of nuclear and hydroelectric power under CPP, with much more renewable energy and natural gas, and less coal. The EIA studies indicate “the Clean Power Plan (CPP) scenarios tend to result in more electricity generation from renewables — especially solar and wind — and (in most cases) natural gas over the next 25 years compared with projections without the CPP (No CPP case). In all cases, coal generation declines, and generation from other fuels such as nuclear or hydroelectricity are relatively unchanged. Power-sector carbon dioxide emissions are lower and retail electricity prices are higher compared with a case without the CPP.”

- Columbia University environmental economist Geoff Heal shows how the U.S. can cut emissions by 80 percent from 2005 levels by 2050, part of its commitment to the Paris Agreement. He finds that the nuclear and renewable energy scenario that avoids large-scale storage may cost less than the scenario with no nuclear and greater use of wind and solar: “U.S. emissions cuts of 80 percent from 2005 levels by 2050 assume extensive use of solar PV and wind energy (66 percent of generating capacity), in which case the cost of energy storage plays a key role in the overall cost. I conclude tentatively that more limited use of renewables (less than 50 percent) together with increased use of nuclear power might be less costly.”

- The Risky Business Project’s 2016 report, “From Risk to Return,” models four distinct pathways that could achieve economy-wide carbon emissions reductions of 80 percent below 1990 levels by 2050. All four pathways — high renewables, high nuclear, high CCS and mixed — include some proportion of nuclear power. The “high renewables” pathway models nuclear deployment by 2050 at a similar rate to today’s. The “high nuclear” pathway models nuclear deployment by 2050 at more than double today’s rate.

- The 2015 U.S. Deep Decarbonization Pathways project describes a “high nuclear” scenario to meet the target of cutting emissions 80 percent below 1990 levels by 2050 that “would require the deployment… of more than 400 GW of nuclear (4 times present capacity).”

- The 2016 U.S. Mid-Century Strategy for Deep Decarbonization outlines six scenarios that employ varying levels of low carbon energy sources and negative emissions technologies like carbon capture and sequestration. All six scenarios include some level of nuclear energy deployment in their 2050 projections: “Building new nuclear plants in the United States remains a challenge due to high investment costs and risks, lengthy licensing and construction periods, and a decline in market competitiveness in certain regions of the country. Continued investments are necessary to extend the lifetimes of the current fleet while also investing in advanced Light Water Reactors and next-generation nuclear plants.”

Pros and Cons of Nuclear Energy

Nuclear power has advantages and disadvantages in terms of cost and emissions. Nuclear plants convert heat created by radioactive decay into electricity, and do not emit the high levels of carbon dioxide produced by fossil fuel-burning power plants, a major contributor to climate change. Nuclear plants also have a high “capacity factor,” meaning they generate more consistent electricity over a given period of time relative to intermittent sources with equivalent maximum capacity. That means that for every day, month or year that a nuclear plant operates, it generates more electricity than another power plant of the same size, but with a lower capacity factor. While this can be an advantage in providing power at a consistent rate, it does not necessarily compensate for the higher cost of nuclear compared to gas and renewables.

The levelized cost of nuclear power (the cost of building, financing and fueling a new power plant while removing all the subsidies) is relatively high compared to other energy sources: the minimum cost per megawatt hour for nuclear is $97, compared to $58 for utility-scale solar, $52 for combined cycle gas, and $31 for wind. Nuclear power is only able to remain viable in power markets due to subsidies. Other analyses of levelized cost show higher figures for all energy sources, but find the cost of nuclear is still significantly higher than solar, wind and gas. Capital costs to build nuclear plants can also run into the billions of dollars, and large plants operate on the old centralized hub-and-spoke model for power distribution, a model that runs counter to the decentralization of distributed renewable energy.

The capital costs for wind and solar technology are projected to decline through 2050, with the costs for concentrated solar power, solar photovoltaics and battery storage expected to fall the most rapidly by mid-century. The cost of nuclear energy, both for maintaining current plants and developing next generation plants, does not support the same downward price curves that exist for wind and solar. In fact, continued government support for nuclear energy is the only thing keeping the industry alive in the U.S., according to the Carlyle Group LP, one of the world’s largest investment firms. In 2016, America’s first new nuclear plant built this century came online in Tennessee, and the U.S. is currently building four other nuclear plants in Georgia and South Carolina. However, the majority of the world’s new plants are in China, India and Russia, all countries that heavily subsidize their nuclear industries. By 2040, the U.S. Energy Information Administration expects that China will account for more than half of total world nuclear energy growth.

Nuclear energy also faces the difficult challenges of disposal of fissile waste, the risk of meltdown from either earthquakes and tsunamis or terrorist attacks, and environmental damage caused by warm water discharge. Many Americans also simply do not want to live near a nuclear power plant for fear of exposure to radioactive material in the event of an accident, despite the low probability of that happening. According to a March 2016 Gallup poll, 54 percent of Americans opposed nuclear power and 44 percent were in favor, the first time that a majority of Americans were opposed to nuclear power since Gallup first posed the question in 1994. Some communities that are home to nuclear plants, however, are strongly supportive since they provide jobs and tax revenue.

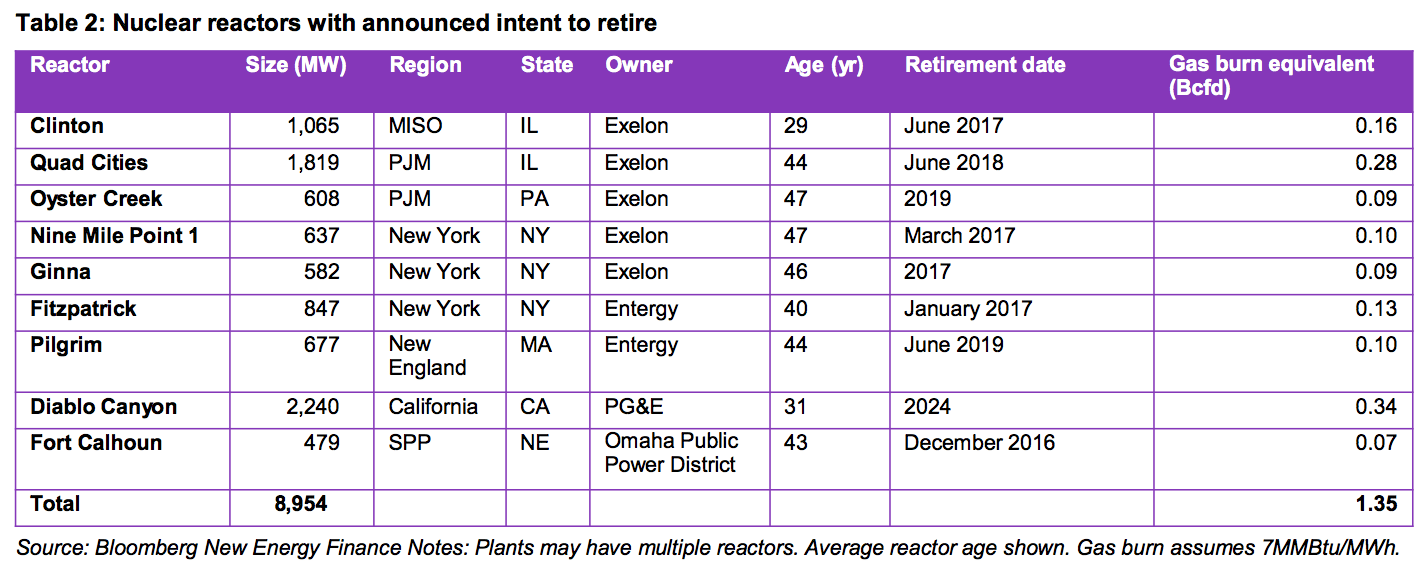

(Compiled from Spark Library and Bloomberg New Energy Finance: *multi-reactor plant)

The 10,286 megawatts of retired or retiring nuclear power represents approximately 10 percent of total U.S. nuclear capacity. In addition to the four plants listed above that are scheduled to close between 2019 and 2025, four more nuclear plants are at risk of closing after May 2017 when PJM Interconnection, the largest U.S. grid operator, will hold an auction to award contracts to power suppliers. If the nuclear bids fail to win contracts, the plants may be forced to close. The Palisades nuclear plant in Michigan may also shut down in 2018 due to “market conditions” that have “substantially changed.” The possible closure would be four years earlier than the plant’s contract expiration date, pending approval by the Michigan Public Service Commission.

Natural gas, renewable energy and relatively small amounts of coal and hydropower have replaced the generating capacity of the five nuclear plants that closed since 2013, all of which are detailed below:

- The California Public Utility Commission allowed the owners of San Onofre Nuclear Generation Station (SONGS), a 2,000-megawatt plant near San Diego, California that closed in 2013, to procure up to 1,500 megawatts of new generating capacity through 2022. The decision required about one third of the new capacity to come from “preferred resources” like renewable energy, efficiency improvements, demand response and energy storage. The plant owners, Southern California Edison and San Diego Gas & Electric, were free to procure the remaining capacity from new gas-fired generation in Los Angeles.

- The closing of the Kewaunee nuclear plant in Wisconsin prompted utilities to burn more fossil fuels. A rise in natural gas prices in 2013 also caused Wisconsin utilities to burn more coal, which increased the state’s power sector emissions.

- When Duke Energy announced it would close its 860 megawatt Crystal River nuclear plant in Florida in 2013 due to the high cost of renovation, it said it would generate or buy power from existing facilities or evaluate sites for a potential new gas-fired plant to make up for the gap. The Crystal River site is also home to four coal-fired plants with a capacity of 2,291 megawatts that remain in service.

- The Vermont Yankee nuclear plant closure in 2014 resulted in an increase in natural gas generation and some imported hydropower from Canada. An analysis of data from the New England Independent System Operator shows that in the year following Vermont Yankee’s closure, nuclear production dropped from 34 percent to 29.5 percent of electricity demand, while natural gas rose from 43.1 percent to 48.6 percent. During the same period, coal-fired generation decreased from 4.6 percent to 3.6 percent.

- Fort Calhoun in Nebraska, the most recent nuclear plant to close in the U.S., shut down operations on October 24, 2016. The head of Omaha Public Power District, which owns Fort Calhoun, said that operating a small plant like Fort Calhoun in a region with abundant wind and gas power does not make sense.

Recent Policy Decisions

Aside from the nuclear plants that have closed or will close in the coming decade, 55 percent of remaining U.S. nuclear capacity will have insufficient revenue to operate profitably in wholesale markets by 2019, according to an analysis by Bloomberg New Energy Finance. In the graph below, the vertical red bars on the left show the “negative profitability” of nearly 50 gigawatts of capacity in the U.S. nuclear fleet by 2019:

(Bloomberg New Energy Finance, via Utility Dive)

Price pressures from natural gas and renewables are not the only factors pushing many nuclear plants into retirement. Climate policies mandating emissions reductions are also having a mixed impact on the future of nuclear power. For example, in deciding whether to maintain or retire their nuclear power plants, New York, California and Illinois have chosen slightly different paths:

- New York, which currently generates most of its electricity from a mix of gas, nuclear and hydropower, has committed to produce 50 percent of its power from renewables by 2030, up from 27 percent today. But the state said that if it allowed its three upstate nuclear plants to retire, wind and solar power might not be able to scale up fast enough to replace the lost nuclear capacity. The New York State Public Service Commission adopted a Clean Energy Standard requiring investor-owned utilities to pay for the value of carbon-free emissions from nuclear plants by purchasing zero-emission credits from those plants. These payments will help financially support New York’s nuclear power plants and allow them to continue operating during the state’s renewable energy transition. The subsidies will run for 12 years starting in April 2017, and though the state has designated these nuclear plants as “public necessities,” critics contend that Gov. Andrew Cuomo (D) has political motivations to boost support with upstate constituencies. In January 2017, Gov. Cuomo announced that the Indian Point nuclear plant in Westchester County would close by 2021, citing the risk of having an ageing nuclear plant close to New York City. It remains unclear what energy sources will replace the lost capacity. (New Jersey is also looking to New York as a potential model for subsidizing nuclear to keep it competitive with natural gas.)

- California has decided that its last remaining nuclear power plant will close by 2024-2025. The Diablo Canyon power plant, located on the coast near San Luis Obispo, provides about 9 percent of California’s electricity, but like other nuclear plants elsewhere in the U.S. is losing revenue due to the rapid growth of low-cost solar and wind power flooding California’s energy markets. State regulators are optimistic that aggressive policies to boost renewables will successfully replace Diablo Canyon when it finally retires, though some analysts worry the utility company could still use gas to make up for the nuclear capacity gap that renewables might not fill.

- The Illinois General Assembly passed a sweeping energy bill in December 2016 that includes $235 million in financial support for two nuclear power plants that were at risk of closing. Gov. Bruce Rauner (R) signed the bill and it will take effect in June 2017. Exelon, the owner of the Clinton and Quad Cities nuclear plants, had warned regulators of the potential relocation of 1,500 jobs out of state should the plants close. The law will keep the two nuclear plants operating for at least 10 years and protects 4,200 related jobs. It also provides annual renewable energy funding of $180 million, growing to $220 million per year, for projects including new wind power plants, utility-scale solar, and rooftop and community solar.

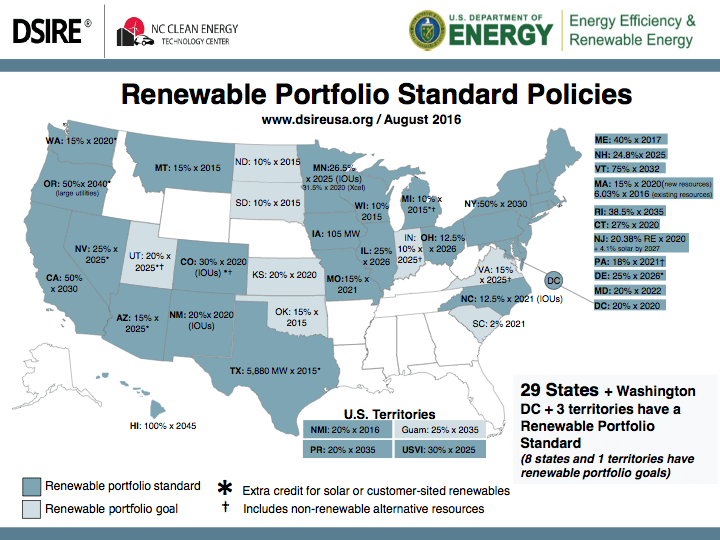

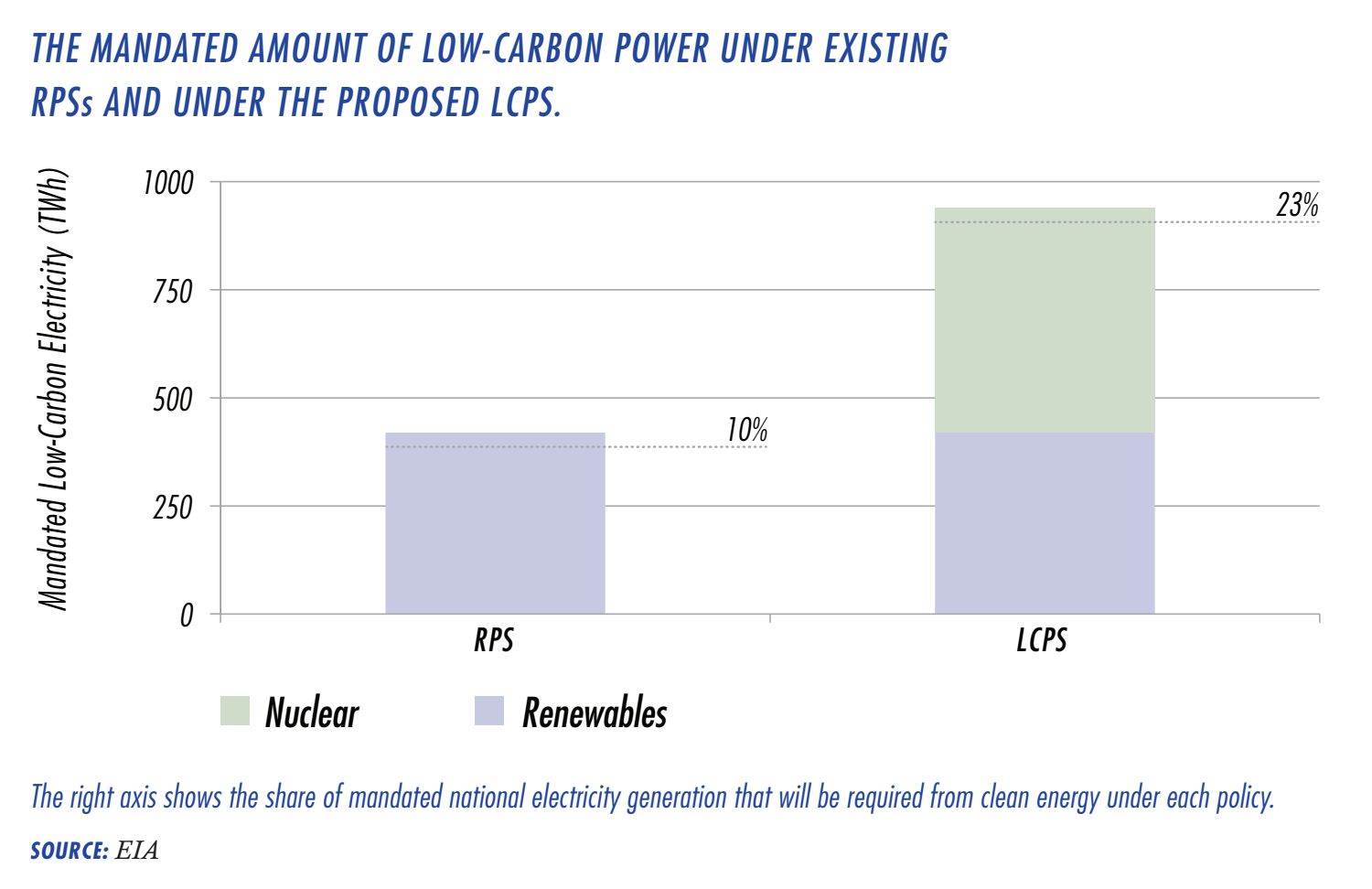

In order to meet emissions reduction targets, some pro-nuclear activists are urging states to integrate nuclear power into their long-term energy plans. The addition of nuclear power to state Renewable Portfolio Standards (RPS) would change these programs into so-called Low-Carbon Portfolio Standards (LCPS). According to the graphic below, the Department of Energy, 29 states, Washington D.C., and three American territories have RPS, and another eight states and one territory have Renewable Portfolio Goals. Standards are current state mandates on emissions and fuel use, while goals set future limits on energy use.

(U.S. Department of Energy and NC Clean Energy Technology Center)

While most of the states with RPS currently have nuclear power as part of their energy mix, only three states — New York, Ohio and Illinois — are considering integrating nuclear power into their emissions reduction plans, effectively swapping their RPS for an LCPS:

(Breakthrough Institute via Greentech Media)

As the map above indicates, the 19 states that have RPS and nuclear energy far outnumber the three states that are considering LCPS. Nuclear power is a high-cost, low-carbon emissions power source that some argue should remain part of the energy mix as states and countries transition from fossil fuels to true renewable sources like wind, solar and hydropower. However, given the rapid installation rate of new utility-scale wind and solar projects in the U.S., California stands out as an example of a state that increasingly sees expensive nuclear energy as a less desirable option for meeting emissions standards.

Policy Disconnect

There is a policy disconnect between the often short time horizon of state and federal policies that allow natural gas to replace retired nuclear capacity over the next ten to fifteen years and the long-term outlook needed to reduce greenhouse gas emissions and limit global temperature from rising 1.5°C to 2°C above preindustrial levels by mid-century. Some states have been rushing to replace ageing, expensive nuclear plants with gas because it is currently a cheap fuel source. However, there is a risk some or most of these plants will become stranded assets, saddling ratepayers with additional costs.

Two contrasting timelines exist: public policies that only extend into the next decade, and infrastructure planning by utilities that goes well into the middle of this century. Under these shorter-term policies, utilities are willing to invest heavily in new gas-fired plants that may have to be decommissioned should stricter emissions rules needed for the 2030-2050 period be implemented. Wind and solar power would likely replace those decommissioned gas plants in the future. In this scenario, investing in clean energy sources now would reduce costs for ratepayers over the long-term.

An additional factor is the contrast between the cost curves for investing in natural gas versus investing in wind and solar. Additional investment in wind and solar drives down the cost for future investments as economies of learning and scale are still being realized in those technologies. In contrast, investment in natural gas power plants does little to affect the cost of future investments, as natural gas is a relatively mature technology.